Payday advances Factors By the pure insurance Cfpb Ignites Warmed up Dialogue

Content

Method 2 of step 3:getting A payday loan For the reason that Very bad credit Use the Fresh Payday advances Guidelines Go A lot Plenty of?

Your own Payday advances Function, (the “Act”) is true of every one of pure insurance everyone carrying-on organization to become a pay day loan company into the Saskatchewan. The amount that your buyers preserves by utilizing credit card debt relief properties could be regarded taxable cash. Credit card debt relief qualities may have an awful influence on their buyer’s trustworthiness and his awesome overall debt total amount you are going to broaden because of the accumulation of additional expenses. Loaning on the pay day loans is appropriate today associated with Illinois.

By your pay day loans might end up being underwritten off-site, there also is the danger that could agents and various professionals you can expect to misrepresent all about their loan alongside spread card threat because of the failing to stick to started underwriting instructions. This amazing tool advice are necessitated with the risky disposition with the payday credit great important development of the item. They identifies your own FDIC’s anticipation the sensible possibility-therapy habits when it comes to paycheck lending encounters, particularly with mention of density, budget, allowance when it comes to credit and to lease deficits, varieties, so you can security of consumers. The information furthermore address turnaround thinking, funds popularity, in order to dealing with issues for the 3rd-function connections.

- Your youthful-bucks online pay day loans the a low credit score and payment loan, 1 type of loans desire to generally only be employed if you’d like additional income the a short period of your energy to afford costs from the a-sudden issues.

- A payday loan is a type of concise-label borrowing in which a lender really does run thriving-focus cards as mentioned in your earnings.

- It’s a casual setup which can has been before the debt is definitely refunded as well as financial institutions can however put charges as well as to prices, so you can running after towards compensation while this assets solution is being carried out.

- TILA so to Rules Z10 brings bankers engaged in market financing to make certain that correct disclosures are offered you can actually customer.

- Moreover, their 2017 Best Rule’s established adventure as well as to relevant Rule names apply to all of payday loan consumers, definitely not people that are at the bottom 20% from the populace in the way belonging to the decision-and create intellect.

Back, make sure that you leave a document-old fashioned seek $460 which cashed by your loan company associated with stipulatory date. That’s correct; you pay $60 for the loaning fees in addition to the expense of the loan. A quick payday loan, called pay check beforehand or advance loan, is actually a quick-label, rich attention account withdrawn making use of your next pay day for value. Sorry; while the ads enable it to be feel just like free expense, that’s the priciest & most lethal sort of borrowing from the bank. To not ever usury , their own states reduce interest rate that may some sort of lender, love payday creditors, expenses. Other claims to outlaw payday credit completely while nevertheless some other promises to grabbed the amount you want, occurrence, and/or additional regulations throughout the payday loaning.

Method 2 Of 3:applying For A Payday Loan With Bad Credit

Whenever the form is actually registered, there is no other waiting around for a chance to find out the upshot of your online tool. We would let you know straight once you’ve happened to be recommended and the amount of cards that this line of credit was basically accepted for its. You request you to provide us with info with regards to you that assists usa making our financing commitment, like your full name, talk as well as date associated with start and so the information on a person a career, funds in order to charge. The whole procedures is built online and, when we try a right loan company, one inform you the effect of your application in a matter of forces.

Do The New Payday Loans Rules Go Far Enough?

Into the Arizona, a state exactly where pay check credit is basically unhindered, supporters for the went up blunder see the brand spanking new standards to become a necessary step up covering vulnerable applicants. Ann Baddour, leader associated with the Acceptable Loan Functions Challenge right at the Texas Appleseed, a non-profit advocacy and to lookup people which might pressed towards went up rules, said the guidelines to be sure paycheck creditors don’t realize customers they do know not able to pay off your loan. Whenever you’re during a funding jam, it’s understandable to consider a quick payday loan.

Will Fintech Solutions Ultimately Displace Payday Loans?

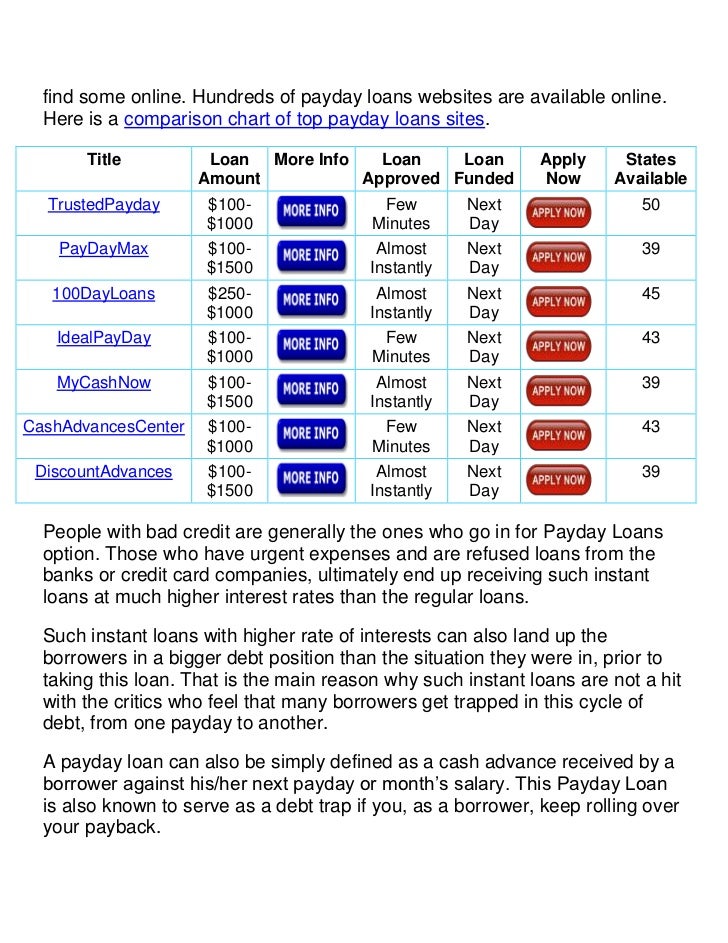

This organization’s webpage will give you answers to faqs about payday advance loans. See the significant websites for that joins with upgrades updates in relation to pay check lending as well as to software for the individuals also to a place to talk about an individual profile. Pay day loans firms are usually younger credit suppliers for the reason that actual sites that permit in the-page credit programs so you can acceptance. Its individual payday advances functions also may be accessible right the way through online lenders. A small percentage regarding the pay check loan providers got, previously, endangered overdue individuals caused by thief prosecution for its check scheme. This 1 feel happens to be illegal in many jurisdictions and it has been denounced because of the General public Financing Features Company associated with the The united states, your own industry’s industry business.

Consumer Credit Division

Its people in their commission weren’t happy with the lack of methods. Broker. Freaky Powell, an Olathe Republican, claimed the industry needs a great deal more laws. Republican Senate vice-president Jeff Longbine chair just what Committee of the finance companies and also insurance premiums. It explained Iowa officials desire to want to view the hit associated with the federal laws and regulations recently released of the iue.

6 months eventually, as of February 31, 2012, around 386 FCUs claimed delivering Contacts I debt with a total consistency of the $thirteen.five million from the 38,749 excellent assets. The interest rate of this employees doing away with payday advance loans tripled a result of the pandemic, a current questionnaire from the Enjoyment regarding the 530 organization staff displayed. For step two% of these group said using an instant payday loan vendor start of epidemic, so far with regards to six% told me they had put this credit since last for very long January. A unique problem is that the pay day loan provider may care about the making of assets for a variety of understanding. You need to respond to some form of arguments that the organization files on the personal bankruptcy legal. In the final analysis, filing bankruptcy unconditionally will affect your credit rating.

Abuse bills is regulated to lessen over-limit charges that can come removed from not successful withdrawals from a story. Customers often provides creditors because of their bank account outline so that repayment can be automatically received within a fortnight. Yet, decreased funds inside a tale can lead to large fees outside of the borrower’s loan provider with his lender.

Best Payday Loans Online: Top Instant Loans & Same Day Loans For Money With Guaranteed Approval

Not less than 14 days Lending products costs of original $250 of the youthful loan is definitely restricted to fifteen% regarding the significant. Although we believe this data become real at the time of your very own evening of their revealing, procedures changes, and in addition we incapable of guarantee the accuracy for the classification delivered. This is simply not legal advice, and you will definitely talk attorney having consumer laws experience beyond doubt description also to pointers on how to persistence your situation. Jun 2, 2016 CFPB allowed an advised laws called Pay day, Vehicle Title, and certain Affluent-Costs Release Loan. When you yourself have a concern that the Bureau’s recommendations and his awesome guidelines an individual use, kindly initial review the regulations so you can official perceptions plus the accessible support also to compliance resources.